IRS forms 668 AC and form 85 19 our levies upon your bank account these levies are not continuous but only affect the amount of money in the bank account on the day the levy arrives you have 21 days to work with the IRS and get the money returned this law office works quickly to gather the documents and contact the IRS for you, so we can get a levy release often secured there are unfilled returns and financial records which need to be reviewed, but this does not end the problem we must gather the necessary documents organize your strategies and prepare an action plan for you to deal with the IRS for the least cost.

Award-winning PDF software

How to prepare Form 668-B

About Form 668-B

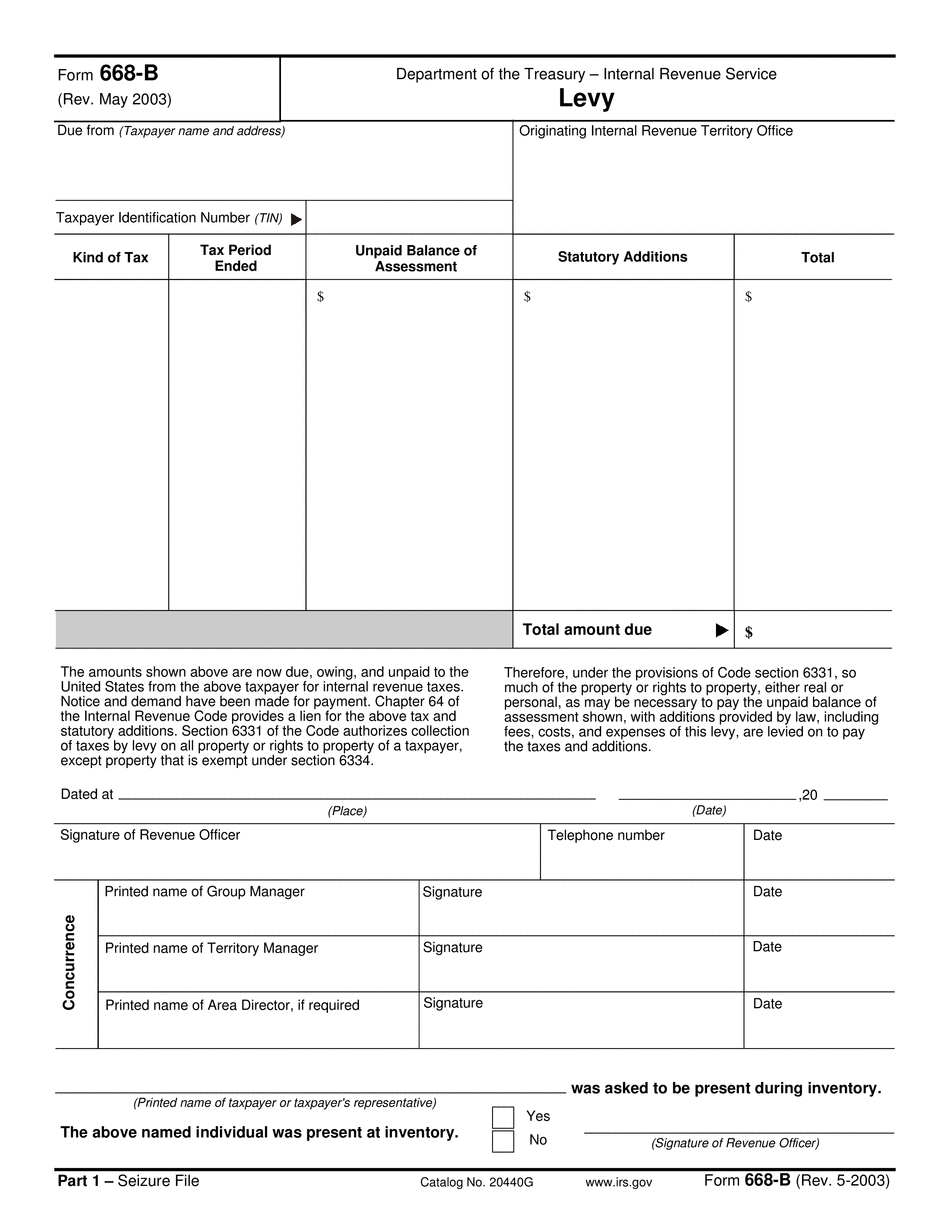

Form 668-B is a notice of levy on bank accounts or other financial assets. It is a legal document that allows the Internal Revenue Service (IRS) to seize funds from a taxpayer's bank account to collect unpaid taxes. The form contains information about the taxpayer, the amount of taxes owed, and the bank account subject to levy. This form is issued by the IRS to a financial institution where the taxpayer has an account. The bank must hold funds in the account up to the amount of the unpaid taxes, and release them to the IRS after a certain time frame if the taxpayer does not respond. The form is typically used when the taxpayer has failed to respond to previous IRS collection notices or has entered into a payment agreement but has not made their payments as agreed. Only the IRS has the legal authority to issue Form 668-B, and only taxpayers with unpaid federal taxes may be subject to this type of levy.

What Is Form 668-B?

Online technologies allow you to organize your document administration and enhance the efficiency of your workflow. Look through the brief guide in an effort to complete Irs Form 668-B, prevent mistakes and furnish it in a timely manner:

How to complete a Form 668b?

-

On the website hosting the document, press Start Now and go to the editor.

-

Use the clues to fill out the relevant fields.

-

Include your individual data and contact information.

-

Make absolutely sure you enter accurate information and numbers in proper fields.

-

Carefully review the data of the form as well as grammar and spelling.

-

Refer to Help section should you have any questions or address our Support staff.

-

Put an electronic signature on your Form 668-B printable with the help of Sign Tool.

-

Once document is finished, click Done.

-

Distribute the prepared document through email or fax, print it out or download on your device.

PDF editor allows you to make improvements towards your Form 668-B Fill Online from any internet connected device, customize it in accordance with your requirements, sign it electronically and distribute in different ways.

What people say about us

It's a smart idea to send forms on the web

Video instructions and help with filling out and completing Form 668-B