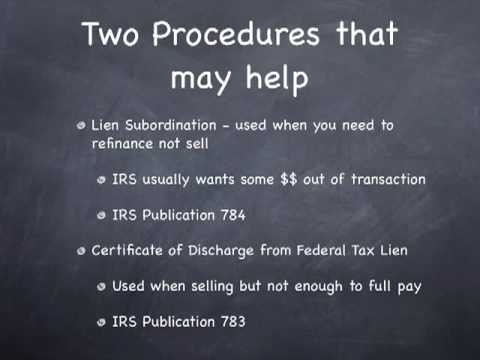

I have a federal tax lien, and I'm trying to sell my house. What do I do? Now, that's a good question. A federal tax lien can be a serious problem when buying or selling a house. Hi, my name is Darrin Mish, and I'm a tax attorney with an international problem tax problem resolution practice based in Tampa, Florida. Now, this video is one of twenty videos. If you'd like to have access to the other 19 videos, please visit our website at getIRShelpvideos.com. So, what do you do in this situation? Well, let me talk about the general rules first. The general rules are that the federal tax lien must be paid off first before you can actually convey your house. That's actually serving the purpose it was invented for, and that's why Congress allows the IRS to file federal tax liens. It is to keep people from conveying their interest in real property and forcing them to pay off the federal tax lien before they sell their house. Now, there are some exceptions to that general rule. The first is the offer and compromise. If you have an offer and compromise accepted and paid, then the IRS has 30 days after the payment of the offer and compromise to release the federal tax lien. The second exception would be the collection statute of limitations. If it has expired, then the IRS again has 30 days from the date of the statute expiration to release the tax lien. That commonly does not happen automatically, so you would have to issue a request to the IRS to release this unenforceable lien, and they have 30 days from the date of that request to do so as well. Now, there's another exception if the lien is otherwise unenforceable. In a situation that comes...

Award-winning PDF software

Irs tax lien sale of property Form: What You Should Know

If the tax lien is not paid it will stay on the property in the form of an IRS tax lien. You may be able to remove those lien payments to relieve the tax lien (e.g. if they are not necessary) by filing Form 4475, Application for Discharge of Tax Lien. 5.17.1.5.3, Section 1.1 (May 2013) 6. 6325(a) — to resolve a tax lien (see paragraph 2.17.1.5.4), you do not need to satisfy a lien or other interest (e.g. claim for refund), you can elect to pay the lien as a separate tax obligation that is the “discretionary” portion of the interest or other amount payable at the time. 6.6325.1 (June 2009) For example, you can make an election to pay the debt or other obligation using the proceeds of your tax loan to the IRS on the amount of the “discretionary” portion. 5.17.1.5.2, Section 9.8 (May 2013) Any property to which the lien applies may be subject to that lien (see paragraph 2.17.1.5.6). 5.17.1.5.1, Section 3.4 (May 2013) Any mortgage that qualifies for the mortgage foreclosure exemption (see section 3.4 of Internal Revenue Service Publication 334 (Tax Guide)). 5.17.1.5.0, Section 3.11 (May 2013) A lien that would not be treated as a mortgage (see section 3.11 of Internal Revenue Service Publication 334). How the Mortgage Bankers Association may affect tax lien claims. — IRS The Mortgage Bankers Association cannot alter or discharge a tax lien on mortgage loans and therefore is immune from any liability or responsibility for property sold by a mortgagee to a third party on behalf of such mortgagee. 5.17.1.5.1 (May 2013) 5.17.1.5.0, Section 3.15 (May 2013) You may not be able to obtain a court order to discharge the tax lien.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668-B, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668-B online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668-B by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668-B from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs tax lien sale of property